Table of Contents

Is nCino owned by Salesforce?

In October 2019, nCino closed its Series D round of funding, a raise of $80 million, led by T. Rowe Price Associates, Inc. Existing investor, Salesforce Ventures, also participated in the Series D round. nCino has been a Salesforce partner since its founding in 2012.

What is nCino and how does it work?

“Built by bankers for bankers, nCino streamlines all customer and employee interactions within a single cloud-based Bank Operating System that drives increased efficiency, transparency, profitability and regulatory compliance across all lines of business. On average nCino client institutions have experienced: 127%

How many employees does nCino have?

In 2019, nCino acquired Visible Equity and FinSuite to accelerate digital transformation efforts for financial institutions worldwide. Today, more than 1,200 passionate, dedicated employees around the globe fuel nCino’s laser-like focus on customer service and product innovation.

What is the nCino bank operating system?

The nCino Bank Operating System, the company’s core product, spans Commercial, Small Business, and Retail lines of business.

See more

What kind of company is nCino?

financial technology companynCino is a financial technology company founded in 2011. It is headquartered in Wilmington, North Carolina. The company’s cloud-based banking software is built on the Salesforce platform for financial institutions to streamline commercial and retail banking needs.

Is nCino a Salesforce product?

nCino’s Bank Operating System is a comprehensive solution built on the Salesforce platform. nCino integrates with core systems, as well as third-party applications to become the single source of truth. nCino customers are seeing tremendous value from using the Bank Operating System.

How much of nCino does Salesforce own?

~11%Salesforce currently owns ~11% of nCino stock.

Who uses nCino?

Companies Currently Using nCinoCompany NameWebsiteSub Level IndustrySantander Holdings USA Inc.santanderbank.comBankingSunTrust Bankstruist.comBankingU.S. Bankusbank.comBankingValley National Bankvalley.comBanking2 more rows

What is the meaning of nCino?

nCino. nCino’s Bank Operating System is a comprehensive, fully-integrated bank operating system that was created by bankers, for bankers, to drive increased profitability, productivity gains, regulatory compliance, and operating transparency at all organizational levels and across all lines of business.

Who are nCino’s competitors?

nCino competitors include Q2, Moody’s Analytics, Finastra, Baker hill and Temenos.

Is Salesforce big tech?

Take a look: Among tech companies, Salesforce tops the list when it comes to sourcing tech talent, surpassing even Amazon and Microsoft. This shouldn’t come as a surprise; the company has positioned itself well to take advantage of all the potential clients that need customer-relationship management (CRM) software.

Is Salesforce a tech giant?

While tech behemoth Salesforce has one of the most liberal workforces in the United States—and the company’s founder, Marc Benioff, is known as the “woke CEO”—many employees appear to have largely been left in the dark about one notable client: the Republican National Committee.

What companies is Salesforce invested in?

To date, Salesforce Ventures has made 527 investments, with Airkit, Forter, and Qualified.com amongst the startups receiving the latest rounds of funding. The company has also made a series of successful exits, including notable ones like Twilio, DocuSign, and HubSpot.

What is the revenue of ncino?

The S-1 filing noted that nCino’s revenue in fiscal year 2020 was $138 million, up from $91.5 million in fiscal year 2019.

Where is ncino located?

nCino is headquartered in Wilmington, North Carolina, with offices in London, Melbourne, Salt Lake City, Sydney, Tokyo, and Toronto.

What is ncino IQ?

Also in 2019, the company announced the launch of nCino IQ, a collection of artificial intelligence and machine learning solutions within the Bank Operating System. At the end of 2019, nCino’s customer base included over 1,100 financial institutions.

Is ncino a bank?

nCino was originally founded as a majority-owned subsidiary of Live Oak Bancshares, a bank holding company. In 2013, nCino raised $9 million in investment funding from a group of investors that included former Morgan Stanley Chairman and CEO John Mack, Promontory Financial Group CEO Eugene Ludwig, and Live Oak Bank Chairman and CEO Chip Mahan. In 2014, nCino received its Series A investment, a $10 million round, from Wellington Management Company LLP, after it experienced a 206% growth in revenue. In February 2015, nCino secured an additional $29 million in a Series B Financing, led by Insight Venture Partners. In 2018, nCino received a $51 million Series C round of venture funding led by Salesforce Ventures, the corporate investment group of Salesforce. In October 2019, nCino closed its Series D round of funding, a raise of $80 million, led by T. Rowe Price Associates, Inc. Existing investor, Salesforce Ventures, also participated in the Series D round. nCino has been a Salesforce partner since its founding in 2012.

Benefits of Connecting nCino and Salesforce

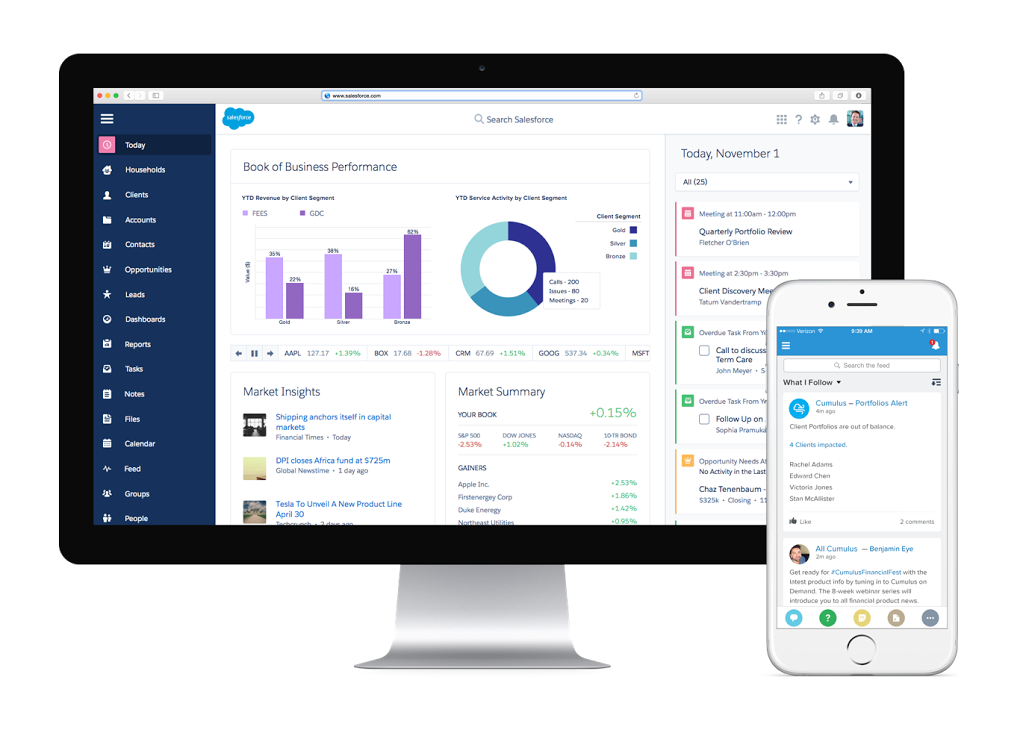

While nCino is built on the Salesforce platform, by combining it with Salesforce Financial Services Cloud, Marketing Cloud, and other tools, you can:

Why Choose Silverline?

As a Salesforce consulting partner, Silverline has over a decade of experience working with Salesforce, along with proven expertise in the banking and lending industry. Our consultants come with first-hand experience and knowledge acquired through thousands of implementations.

Things to consider before installing FSC into your nCino org

When you install FSC into your nCino org, there are many considerations you’ll want to take into account. Based on your setup, you’ll want to review your processes, record types, data models, and more.

Client Success Stories

Learn how Silverline helped these companies leverage Salesforce and nCino to significantly improve their business.

Overview

nCino is a financial technology company founded in 2011. It is headquartered in Wilmington, North Carolina. The company’s cloud-based banking software is built on the Salesforce platform for financial institutions to streamline commercial and retail banking needs. nCino’s customers include TD Bank, Truist Financial, and Santander Bank. nCino’s strategic partners include Accenture, Del…

History

nCino was founded by a team of bankers. Since then, nCino’s Bank Operating System has expanded beyond commercial banking, also addressing small business and retail banking.

In 2013 nCino hosted its first nSight User Conference. In 2015, nCino signed its 100th customer. In 2017, nCino opened its first international office in London, England. In 2018, nCino expanded its global office footprint to Sydney, Australia. nCino closed out the decade strong as it executed o…

Products

The nCino Bank Operating System, the company’s core product, spans Commercial, Small Business, and Retail lines of business. The Bank Operating System encompasses the following capabilities: loan origination, portfolio analytics, compliance and risk management, digital customer engagement, customer relationship management (CRM), client onboarding, deposit account opening, business process automation and enterprise content management.

Business and Markets

nCino is headquartered in Wilmington, North Carolina, with offices in London, Melbourne, Salt Lake City, Sydney, Tokyo, and Toronto. The company’s Bank Operating System is used by banks and credit unions with assets ranging from $30 million to $2 trillion. nCino serves the following countries: United States, Canada, Western Europe, Australia, and Japan. The company’s customers include Wells Fargo, Bank of America, KeyBank, and US Bank.

Acquisitions

In July 2019, nCino acquired Visible Equity, a financial analytics and compliance software company based in Salt Lake City, Utah. Visible Equity added the following capabilities to the nCino Bank Operating System: Loan Analytics, Deposit Analytics, Application Analytics, Customer Analytics, ALLL/CECL Compliance Analytics, Fair Lending Analytics.

In November 2019, nCino announced its second acquisition, that of FinSuite, a software compan…

Funding

nCino was originally founded as a majority-owned subsidiary of Live Oak Bancshares, a bank holding company. In 2013, nCino raised $9 million in investment funding from a group of investors that included former Morgan Stanley Chairman and CEO John Mack, Promontory Financial Group CEO Eugene Ludwig, and Live Oak Bank Chairman and CEO Chip Mahan. In 2014, nCino received its Series A investment, a $10 million round, from Wellington Management Company LLP, after i…

Philanthropy

In 2021, nCino donated $1.3 million to the city of Wilmington sports complex park, becoming the official new sponsor. Formerly known as the Cape Fear Regional Sports Park, the park is now named the nCino Sports Park and is scheduled to open in the fall of 2022.

nCino partnered with the Food Bank of Central & Eastern North Carolina in the fall of 2021, pledging to donate $1 million over a five-year period toward a new Hunger Solutions Center.

Awards and recognition

In 2019, nCino was recognized as the top vendor by Aite Group in the analyst firm’s report titled “Commercial Loan Origination: Evaluating Vendors That Hone the Tip of the Spear”.

In 2019, nCino ranked No. 20 Forbes Cloud 100 List, an annual ranking of private cloud-computing companies in the tech sector.

In 2019, nCino was named as the #1 Best Fintech to Work For by American Banker magazine.