Yes, PayPal fees related to collecting money from customers or clients and operating your business are, in fact, deductible and will reduce taxable income. Let’s explore which processing fees you can deduct when you do your PayPal taxes. Note: if you want to automatically track and record all your tax deductions, try Bonsai Tax.

Table of Contents

How does PayPal deduct fees?

How are PayPal fees deducted? May-09-2010 07:36 AM Fees are based on the TOTAL Amount of the transaction. When someone pays you, PayPal deducts their fee from the Total Amount and deposits the remaining balance into your PayPal Account.

How much does PayPal charge for sales on sale items?

For example, if you sold an item and Total Amount of the sale was $40, the buyer pays, PayPal charges 2.9% plus $.30 which on $40 is $1.46. You get the remaining balance of $38.54.

How to avoid PayPal fees?

Once PayPal charges the applicable fees, you would be left with the original total due of $1,300. While you need to include these expenses in your contract and let the client know what will be charged, this is a completely viable method for avoiding PayPal fees. 2. Receive fewer payments This method is effective, but only to an extent.

Is there a fee for using PayPal with invoicely?

However, there is no fee for doing so. If you use PayPal with any regularity, planning ahead can help save you quite a bit of cash. Together with PayPal, invoicely offers a hassle-free, reliable way for clients to pay you for products or services.

1. RECEIVE FASTER PAYMENTS

The Salesforce PayPal integration acts as a funnel to direct payments from multiple sources onto a centralized platform. While the Salesforce database plays an important role in receiving and managing payments.

2. GAIN BETTER CONTROL ON PAYMENTS

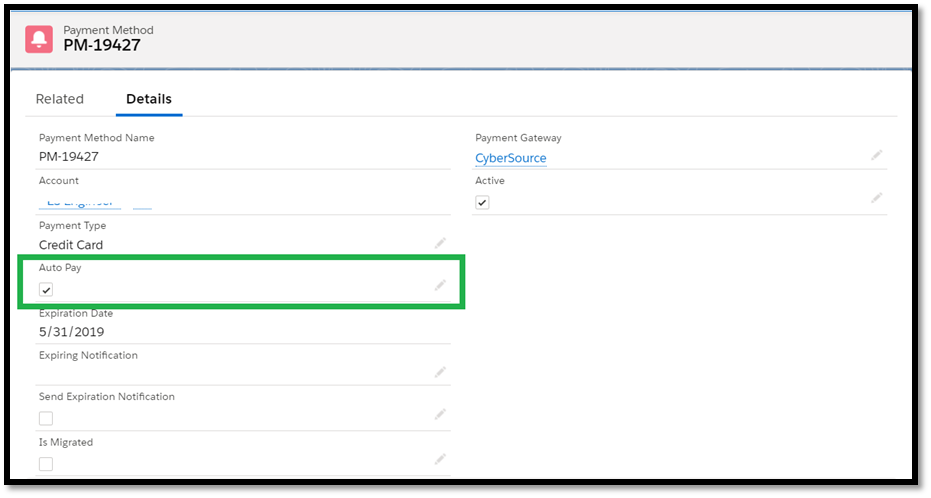

The integration gives you more control in receiving payments and configuring your payment options or even modifying them according to your customers’ changing needs.

3. ACCESS SENSITIVE INFORMATION SAFELY

The Salesforce PayPal integration gives your staff admittance into live PayPal client information, like PayPal payments and payment methods from inside Salesforce, including bank account transfers, credit, and debit card payments.

4. LEVERAGE DEEPER CUSTOMER INSIGHT

With this integration, you can obtain a 360-degree view of your customers. As you can track any individual customer’s purchase history and the amount they spent buying your products. You can also ascertain details such as their declined payments, refunds, accounts standing, and scheduled orders.

5. GET REAL-TIME REPORTS

The Salesforce PayPal integration brings PayPal information into Salesforce. It helps you leverage intuitive and responsive dashboards and user-friendly reports, sourced from your live PayPal analytics, and synced into your Salesforce.

6. IMPROVE DATA TRANSPARENCY AND EFFICIENCY

The integration makes all PayPal payments visible in Salesforce as native data, which is presented in an intuitive and user-friendly format. So, your team gets access to the client’s PayPal payment details in Salesforce (in real-time) and is always updated.

7. INCREASE AUTOMATION FOR BETTER ACCURACY

Traditional manual methods of keeping track of payments are bound to cost you sooner or later. Hence the Salesforce PayPal integration, provides you with the necessary automation, to automate a majority of these processes, leading to increased accuracy of processing and recording payments.

Introduction to Paypal

PayPal is a digital payment service that customers can use while shopping online. PayPal stores payment info, such as bank account or credit card numbers, so that customers don’t have to type out the numbers every time they buy something. PayPal also hides this financial information from businesses, adding a layer of security to online shopping.

Paypal salesforce Integration

Now that you have a brief overview of Salesforce and Paypal, this section deals with the Paypal Salesforce integration.

Conclusion

This Article gave a comprehensive guide of Salesforce and Paypal. It also gave a step-by-step guide on Paypal Salesforce Integration.

Tax Deductions For PayPal Fees

Fees are calculated based on the transaction’s TOTAL AMOUNT. PayPal deducts their charge from the Total Amount and puts the leftover balance into your PayPal Account when someone pays you.

Other Deductions You Can Claim On Your Taxes

It’s important to keep receipts (digital or physical) of expenses or deductions to limit how much you pay Uncle Sam. On top of processing fees from PayPal, you can claim many more deductions as a self-employed business.

Try Bonsai Tax To Help You Record Tax Deductions

Listen, handling taxes for your business doesn’t have to stress you out. With Bonsai Tax, we’ll track all your tax deductions automatically. You won’t have to worry about what counts as a tax deduction or how to properly track receipts. Our app will do all of that for you. Try a 14-day free trial today.

What is PayPal payout percentage?

Sending money using PayPal Payouts such that your recipients receive a different currency from the currency in which you pay. 4.00%, or such other amount as may be disclosed to you during the transaction. All other transactions. 3.00%, or such other amount as may be disclosed to you during the transaction.

What is a commercial transaction on PayPal?

When you buy or sell goods or services, make any other commercial type of transaction, or receive a payment when you “request money” using PayPal, we call that a “commercial transaction”.#N#For the listings of selling rates, please visit our PayPal Merchant Fees Page.

What is PayPal Cash Plus?

PayPal Cash and Cash Plus. PayPal offers two types of balance accounts commonly referred to as PayPal Cash and PayPal Cash Plus. For more information and a complete listing of fees associated, please refer to the PayPal Cash and PayPal Cash Plus Terms and Conditions. Back to top.

Is there a fee for PayPal credit card verification?

No Fee. Credit Card and Debit Card Confirmation (s) Some users, in order to increase their sending limit or as PayPal may determine, may be charged a credit card and debit card link and confirmation fee. This amount will be refunded when you successfully complete the credit card or debit card verification process.

Is there a fee for crypto?

The exchange rate you’ll see before buying or selling crypto will also include a cryptocurrency conversion spread. There’s no fee for holding crypto in your account.

How to cut down on PayPal fees?

Here are just a few of these methods, as well as why you should or should not use them: 1. List PayPal fees as a billable expense. Perhaps the best way to offset PayPal fees for receiving money is by passing them on as a billable expense.

What is the fee percentage for online payments?

and are accepting online payments, your fee percentage would be: 2.9% if your client’s bank account is within the U.S. 4.4% if your client’s bank account is outside the U.S.

How to transfer PayPal money to checking account?

Generally, there are two ways to move money from your PayPal balance to your checking or savings account: First, you can transfer your chosen amount directly to a debit card. This transfer takes only a few seconds to complete. However, you’ll be charged 1 percent — but no more than $10 — for doing so.

Is invoicely a reliable payment method?

Together with PayPal, invoicely offers a hassle-free, reliable way for clients to pay you for products or services. And when you have a whole business to run, easy is a necessity.